When cost-effective financing is unavailable for worthy projects, state governments can and do step in to help. Governments use their power and their pocketbook to reduce risk for banks and investors, helping businesses by increasing access to capital through loans or investment. A large number of American University’s faculty, myself included, have expertise in economic development, and bring this expertise to the classroom.

‘Not a cheerleading exercise.’ City initiative to jumpstart local … – Courier Journal

‘Not a cheerleading exercise.’ City initiative to jumpstart local ….

Posted: Tue, 08 Aug 2023 18:42:43 GMT [source]

A NCRS would have a similar economic effect as full expensing but would decrease the cost over the 10-year budget window, reducing the initial cost of improving the tax treatment of structures. Forms of economic nationalism and neomercantilism have also been key in Japan’s development in the 19th and 20th centuries, and the more recent development of the Four Asian Tigers (Hong Kong, South Korea, Taiwan, and Singapore), and, most significantly, China. Access to financing is critical to businesses small and large looking to start new ventures, expand existing ones, or relocate facilities.

Related Resources

Their economies rely on many different people and organizations performing specialized tasks. Agriculture and raw materials represent only part of the economy of a developed country. Other sectors include manufacturing, banking and finance, and services such as hairdressing or plumbing.

This may be well below the simple arithmetic average of per capita income or consumption when national income is very unequally distributed and there is a wide gap in the standard of living between the rich and the poor. Development economics studies the transformation of emerging nations into more prosperous nations. Strategies for transforming a developing economy tend to be unique because the social and political backgrounds of countries can vary dramatically. Not only that, but the cultural and economic frameworks of every nation is different also, such as women’s rights and child labor laws. We estimate that on a conventional basis, enacting full expensing would reduce federal revenue by $1.64 trillion from 2021 through 2030.

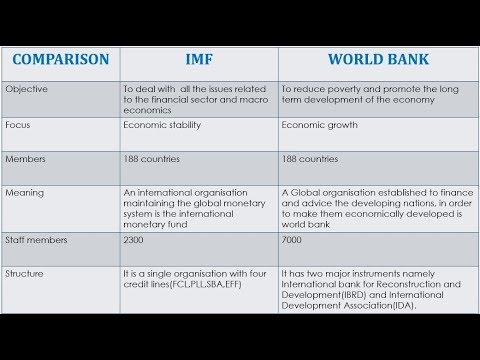

Multilateral Lenders and Regional Development Banks – Lexology

Multilateral Lenders and Regional Development Banks.

Posted: Wed, 09 Aug 2023 14:38:18 GMT [source]

This includes the upcoming amortization of R&D expenses scheduled to take place in 2022. Delaying deductions means the present value of the write-offs (adjusted for inflation and the time value of money) is less than the original cost—how much less valuable depends on the rate of inflation and the discount rate. Thus, this system of tax depreciation, rather than full expensing, is highly unfavorable and increases the after-tax cost of making investments, leading to a lower level of investment and economic growth. Since public health advancement involves a substantial cost, development economics is crucial. Furthermore, countries outside the tropic zones, which have more temperate climates, have also developed considerably more than those located within the Tropic of Cancer and the Tropic of Capricorn. Families and small communities often make their own food, clothing, housing, and household goods.

Historical development of economics

Investing in technology and innovation and attracting investors through unique products for example, are good ways to develop and improve the economy for the long term. They also include international trade, globalization, sustainable development, the effects of epidemics, such as HIV, and the impact of catastrophes on economic and human development. Students of economics, and professional economists, create theories and methods that guide practitioners in determining practices and policies that can be used and implemented at the domestic and international policy level. The field also examines both macroeconomic and microeconomic factors relating to the structure of developing economies and domestic and international economic growth. While full expensing for all types of investments would result in the largest boost in investment and economic growth, at the very least, scheduled tax increases on capital investment should not be allowed to occur.

We estimate that the long-run annual cost of neutral cost recovery for structures and full expensing for all other assets is $61 billion on a conventional basis (in 2020 dollars). Using the Tax Foundation General Equilibrium Model, in Table 4 we estimate the effect of a NCRS system for investments in 27.5-year and 39-year structures (residential and nonresidential, respectively) and a policy of full expensing for all other assets. The transition costs of moving to full expensing for all assets may deter lawmakers from pursuing the policy. However, this treatment can be expanded to buildings and structures in a way that lowers the upfront cost while providing nearly equivalent economic benefit.

Techniques used in this type of economic development strategy include limiting import amounts or setting tariffs to raise the cost of importing certain products and applying subsidies to promote the trading of desirable items. An extreme trade strategy might include an embargo, which is a policy that essentially cuts off trade with a certain country or governmental entity. This document provides recommendations on what should be included in each of the sections required by EDA’s regulations, and suggests tools, resources, and examples to help in each section’s development.

Theories of development economics

Economic Development Administration’s (EDA) programs, but successfully serves as a means to engage community leaders, leverage the involvement of the private sector, and establish a strategic blueprint for regional collaboration. The CEDS provides the capacity-building[1] foundation by which the public sector, working in conjunction with other economic actors (individuals, firms, industries), creates the environment for regional economic prosperity. Economic development is the priority of local, state and federal government as it will lead towards an upgrading in innovation and new ideas, higher literacy rates, creation of jobs, improved environment, creation of higher wealth, labor support and better quality of life. Economic growth and development is an important area of study that students can study in institutions like Norman Paterson School of International Affairs and International Institute of Social Studies. Economists primarily focus on the growth aspect and the economy at large, whereas researchers of community economic development concern themselves with socioeconomic development as well. Ultimately, the study of development economics is meant to help better the financial, economic and social circumstances in developing countries through the enactment of certain structures and policies.

While a difference of, say, 10 percent in per capita incomes between two countries would not be regarded as necessarily indicative of a difference in living standards between them, actual observed differences are of a much larger magnitude. The topics, or types of development economics include mercantilism, economic nationalism, linear stages of growth model, and structural-change theory. We estimate that enacting a policy of full expensing for all capital investments, including machinery, equipment, buildings, structures, and R&D expenses, would increase the long-run level of gross domestic product (GDP) by 5.1 percent. The capital stock would expand by 13 percent, wages increase by 4.3 percent, and employment grow by more than 1 million full-time equivalent jobs. Improving capital cost recovery will be crucial to the post-pandemic effort to increase investment and economic growth. Under the U.S. tax code, businesses can generally deduct their ordinary business costs when figuring their income for tax purposes.

What is Economic Development?

The synthetic control method is an increasingly popular method for state policy evaluation. It provides quantitative support for case studies by creating a synthetic control region that simulates what the outcome path of a region would be if it did not undergo a particular policy intervention. In this report, we describe the method and provide simple step-by-step guidance for its application.

Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss. Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all. End hunger, achieve food security and improved nutrition and promote sustainable agriculture. An example of a programmatic metric would be a number of additional firms (e.g., start-ups) that formed as a result of services (e.g., access to state-of-the-art equipment or facilities) funded by a grant. EDA grantees report on direct or directly-attributable jobs, including subsequent employers that locate or expand in the project area as a result of the project. For some projects (e.g., roads, water and sewer lines), direct jobs may include those created by firms that were not originally anticipated as part of the project but required the facility or service provided by the EDA project in order to locate or expand in the area.

- However, they are all large countries with large economies that are growing very quickly.

- Second, the poverty of a country is more faithfully reflected by the representative standard of living of the great mass of its people.

- This raises the income of people in rural areas, as well as allowing more people to work in jobs outside agriculture.

- An important characteristic of economic development is that the process will help in structural changes and more opportunities from agriculture to manufacturing to the service sector.

- To achieve this, the current depreciation schedules for residential and nonresidential buildings, 27.5 years and 39 years, respectively, would remain, but deductions would be adjusted to compensate for the delay by accounting for inflation and the time value of money.

Economic development is often defined by others based on what it is trying to accomplish. Simply put, a CEDS is a strategy-driven plan for regional economic development. The CEDS provides a vehicle for individuals, organizations, local governments, institutes of learning, and private industry to engage in a meaningful conversation and debate about what capacity building efforts would best serve economic development in the region. The CEDS should take into account and, where appropriate, integrate or leverage other regional planning efforts, including the use of other available federal funds, private sector resources, and state support which can advance a region’s CEDS goals and objectives. Regions must update their CEDS at least every five years to qualify for EDA assistance under its Public Works and Economic Adjustment Assistance programs. In addition, a CEDS is a prerequisite for designation by EDA as an Economic Development District (EDD).

Mercantilism

Some economists believe that by 2050, the economies of BRIC countries will be larger than the United States or the European Union. Developed countries have a high life expectancy, or the average number of years a person can expect to live. Japan, a highly developed nation, has the highest life expectancy of any country, at 82.7 years.

However, this is not always the case for the costs of capital investments, such as when businesses purchase buildings. Typically, when businesses incur these sorts of costs, they must deduct them over several years according to preset depreciation schedules, instead of deducting them immediately in the year the investment occurs. A growing body of research types of economic development has been emerging among development economists since the very late 20th century focusing on interactions between ethnic diversity and economic development, particularly at the level of the nation-state. While most research looks at empirical economics at both the macro and the micro level, this field of study has a particularly heavy sociological approach.

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth. We estimate that full expensing for all capital investments would boost economic output by 5.1 percent, wages by 4.3 percent, and create more than 1 million full-time equivalent jobs over the long run. To reduce the short-term cost of full expensing for structures, lawmakers could use a neutral cost recovery system (NCRS), which would provide a nearly equivalent economic effect at a lower initial cost, pushing the greater costs to the outyears. You could ask ten different people what economic development is and easily get ten different answers! In general, economic development is usually the focus of federal, state, and local governments to improve our standard of living through job creation and ultimately a better quality life.

The HDI measures standard of living by GDP per capita income, knowledge by combining literacy rate of adults and total tertiary, secondary and primary gross enrolment ratio and longevity by life expectancy at birth. This composite indicator keeps track of changes in the level of economic development of a country over time. Trade or commercial development strategies make changes to the way a country deals with other countries, mainly in a financial sense. This can include increasing or reducing aid to countries in need of economic assistance or changing policies, costs, and rules relating to international trade.

Major European nations in the 17th and 18th centuries all adopted mercantilist ideals to varying degrees, the influence only ebbing with the 18th-century development of physiocrats in France and classical economics in Britain. Mercantilism held that a nation’s prosperity depended on its supply of capital, represented by bullion (gold, silver, and trade value) held by the state. It emphasised the maintenance of a high positive trade balance (maximising exports and minimising imports) as a means of accumulating this bullion. To achieve a positive trade balance, protectionist measures such as tariffs and subsidies to home industries were advocated.